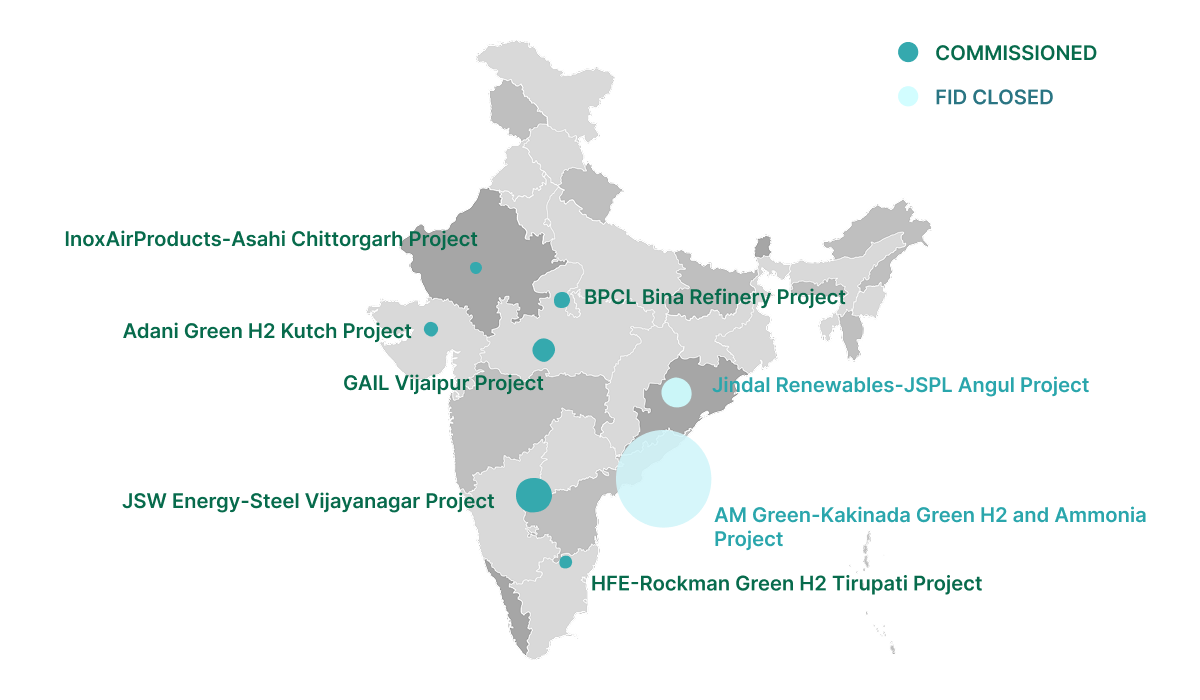

Green H2 Projects (Commissioned and FID Stage*)

| Project | Use Case | Green H2 Capacity | Electrolyser Capacity |

|---|---|---|---|

| Inox Air Products – Asahi Chittorgarh | Glass manufacturing (Captive use) | 0.25 TPD | 800 kW AK-EC |

| GAIL – Vijaipur Project | Natural gas blending (Captive use) | 4.3 TPD | 10 MW PEC-EC |

| JSW Energy – Steel Vijayanagar | Hydrogen injection in steel making (Captive) | 10 TPD | 25 MW AK-EC |

| Jindal Renewables – JSPL Angul | DRI plant steelmaking (Captive use) | 13 TPD | 30 MW AK-EC |

| AM Green – Kakinada Project | Export-oriented green hydrogen and ammonia | 1400 TPD | 640 MW AK-EC (Phase 1) |

| HFE – Rockman Tirupati Project | LPG/PNG blending in alloy wheel manufacturing | 0.1 TPD | 300 kW PEM-EC |

| Adani New Industries Ltd.- Kutch, Gujarat | Off-grid hydrogen plant (Captive use) | 2.15 TPD | 5 MW AEC |

* TPD = Tonnes per day / MW/kW refers to electrolyser power capacity

** AK-EC = Alkaline Electrolyser Cell / PEM-EC = Proton Exchange Membrane Electrolyser Cell

India Hydrogen Projects

India is witnessing significant momentum in the advancement of green hydrogen projects, with several initiatives either commissioned or at the Final Investment Decision (FID) stage. These projects span across domestic industrial and captive offtake models, including five captive-model initiatives—three led by steel and alloy manufacturers, two by industrial and natural gas players, and one by a major refinery—as well as one merchant-model project spearheaded by a leading renewable energy company. Public sector procurement efforts are currently underway, with key developments driven by three captive projects from public sector refinery companies and one merchant project. Notable initiatives include Indian Oil Corporation Limited’s (IOCL) Green Hydrogen project at the Panipat Refinery, where tendering for a 40 MW electrolyzer capacity is expected by June–July 2025; Oil India and Numaligarh Refinery Limited’s (NRL) Green Hydrogen initiative for the Assam Refinery; and NTPC Renewables’ Hydrogen and Ammonia Hub in Visakhapatnam, where the offtaker is yet to be confirmed and tendering is nearing completion. These public sector-led refinery projects are strategically positioned to accelerate the scaling of green hydrogen production and secure substantial offtake volumes, thereby playing a pivotal role in shaping India’s emerging hydrogen economy.

Hydrogen Purchase Obligations

IH2A has made a formal submission to the Government of India proposing Hydrogen Purchase Obligations (HPOs) and Demand Side support for Refineries and Ammonia Plants, 10% HPO for existing plants and 100% HPO for new plants by 2030, to achieve the NGHM 2030 target of 1.5 MT green hydrogen for domestic use in India. IH2A has submitted that without HPOs and adequate offtake and demand creation, NGHM 2030 targets and combined hydrogen-related investments worth USD 80 bn are at risk

For more information, click here.

Kochi Green Hydrogen Hub

Kerala was the first state government to make USD 48.2 million (INR 400 crores) allocation for green hydrogen projects/hubs in its state budget. The German Development Agency, GIZ, and the Government of Kerala are jointly working to build the Kochi Green Hydrogen Hub. The government’s not-for-profit company under State RE agency ANERT is being created, to support project development, with public finance.

IH2A’s collaboration with the Govt of Kerala is currently most advanced, on the back of the Green Kochi Hydrogen Hub (GKH2) plan that was proposed by IH2A and that is being currently taken forward by Kerala. IH2A provides non-commercial advisory support to Kerala on green hydrogen project development and industry stakeholder engagement.

IH2A Kochi Hub Model Know more.

Hydrogen Maturity Mapping

The IH2A Secretariat team is tracking key industry participants and stakeholders in the nascent Indian hydrogen (H2) market. These entities have been categorized into five groups:

(1) Present/Potential Project Developers,

(2) Financial Investors,

(3) Equipment Manufacturers (for Industrial and Transport Use-Cases), and

(4) Offtake Entities (primarily domestic).

The team has utilized publicly available information, supplemented by additional inputs where possible, to rank all entities on a scale of 1–5.

The ranking rationale is detailed on the next page and in the H2 Maturity Monitor Worksheet (accessible via the IH2A Members Login under Member Resources / H2 Stakeholders-Positions folder).

Public funding (Government-Led)

- National Green Hydrogen Mission

- In January 2023, Indian government approved USD 2.31 billion (Rs. 19,744 crore) for National Green Hydrogen Mission (NGHM), including USD 2.04 billion (Rs. 17,490 crore) for Strategic Interventions for Green Hydrogen Transition (SIGHT), USD 170.6 million (Rs. 1466 crore) for pilot projects, USD 46.6 million (Rs. 400 crore) for R&D, and USD 45.24 million (Rs. 388 crore) for enabling components.

- In budget 2024-25, NGHM allocation of USD 69.96 million (Rs. 600 crore) withing a total MNRE budget of USD 2.226 billion (Rs. 19,100 crore).

- SIGHT incentive commitment of USD 2.04 billion (Rs. 17,490 crore) through 2029 targeting electrolyser manufacturing (15GW) and green hydrogen/ammonia production (4,12,000 tonnes)

- Hydrogen Valley Innovation Clusters (HVICs)

- June 2024: Department of Science and Technology (DST) approved USD 5.83 million (₹50 crore) each over five years (total Rs. 200 crore or USD 23.32 million) for four HVICs in Kerala, Pune, Bhubaneswar, Jodhpur .

- January 2025: Kerala State approved HVIC‑Kerala as a not‑for‑profit, supported by USD 15.6 million (Rs. 130 crore) for a hydrogen valley cluster project.

- Green Hydrogen Hubs (Ports)

- MoPSW designated Kandla, Paradip, and V.O. Chidambaranar (Tuticorin) in 2023 as future green-hydrogen/export hubs; Tamil Nadu allocated 500 acre for hub development .

Private & Multilateral Funding

The development of India's green hydrogen sector is being significantly propelled by a mix of private sector investment and support from multilateral financial institutions. Currently, India has USD 80 billion+ investments in active green hydrogen project from players like Relaince, JSW, HFE etc . Some of the key mult funding has been:

- The World Bank has approved significant financing to support India's low-carbon energy transition. In June 2023, it approved a $1.5 billion loan to support the scaling up of renewable energy. This was followed by a similar $1.5 billion loan in July 2024 to accelerate the transition to a renewable hydrogen market and support the manufacturing of electrolyzers.

- European Investment Bank (EIB): The EIB is a key partner in India's green hydrogen ambitions and IH2A. The EIB has committed indicative funding of €1 billion for large-scale green hydrogen hubs and projects across India.

- The German development bank KfW has provided approximately €1 billion in concessional loans to support the Indo-German solar partnership and development of green energy corridors, which is a vital component for green hydrogen production.